Introduction

In today’s economic climate, student loan debt continues to be one of the most pressing financial challenges for millions of graduates across the United States. Refinancing has emerged as a viable strategy for borrowers seeking to lower interest rates, reduce monthly payments, or pay off loans faster. Among the many refinancing providers, Earnest stands out for its flexible terms, data-driven underwriting, and borrower-friendly features. This article offers a comprehensive 5000-word guide on refinancing with Earnest, outlining what it is, how it works, who it’s for, its advantages and disadvantages, the application process, comparisons with other lenders, and strategic advice to help you make informed financial decisions.

1. Understanding Loan Refinancing

Loan refinancing involves taking out a new loan to pay off one or more existing student loans, ideally at a lower interest rate or with better repayment terms. The main objectives of refinancing are:

- Reducing the interest rate

- Lowering monthly payments

- Changing the loan term

- Consolidating multiple loans into one

- Switching from a variable to a fixed rate (or vice versa)

2. Introduction to Earnest

Earnest is a fintech company founded in 2013 and acquired by Navient in 2017. It focuses on providing personalized student loan refinancing options using non-traditional data, such as earning potential, spending habits, and savings behavior, in addition to standard credit scores. Earnest positions itself as a modern, flexible lender that empowers borrowers with customized repayment terms.

3. Eligibility Requirements for Refinancing with Earnest

To refinance with Earnest, applicants must meet certain eligibility criteria:

- Be a U.S. citizen or permanent resident

- Have graduated with at least a bachelor’s degree from a Title IV-accredited institution

- Be employed or have a written job offer

- Have a minimum credit score (usually 650+)

- Maintain responsible financial habits (e.g., no recent bankruptcies)

- Reside in a state where Earnest offers loans (as of this writing, all except Nevada)

4. Key Features and Benefits of Earnest Loan Refinancing

Earnest sets itself apart in several ways:

- Precision Pricing: Choose a repayment term down to the exact month (between 5 and 20 years).

- No Fees: No origination, prepayment, or late fees.

- Customizable Repayment: Change payment dates, make extra payments anytime.

- Skip a Payment: Option to defer one payment per year without penalty.

- Automatic Payment Discounts: 0.25% interest rate reduction for autopay.

5. Interest Rates and Loan Terms

As of 2025, Earnest offers:

- Fixed APRs starting around 4.99%

- Variable APRs starting around 5.25%

Loan terms range from 60 to 240 months. Rates depend on your credit profile, income, debt-to-income ratio, and financial behaviors.

6. The Application Process: Step-by-Step

Applying to refinance your student loan with Earnest typically includes:

- Prequalification:

- Soft credit check

- Estimate your rates without affecting your credit score

- Application:

- Submit documents: ID, pay stubs, tax returns, current loan statements

- Provide employer details and educational history

- Approval:

- Earnest evaluates your financial profile and determines eligibility

- Loan Offer:

- Choose your preferred rate and term

- Loan Disbursement:

- Earnest pays off your previous loan(s) and issues the new loan

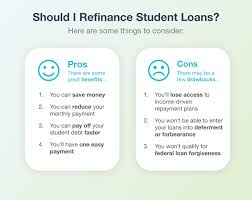

7. Pros and Cons of Refinancing with Earnest

Pros:

- Highly flexible terms

- Transparent pricing

- Personalized underwriting model

- No hidden fees

- Helpful customer service

Cons:

- No co-signer options

- Not available in all states (e.g., Nevada)

- Requires good to excellent credit

- No federal loan benefits (e.g., income-driven repayment plans, PSLF)

8. Comparison with Other Lenders

| Feature | Earnest | SoFi | Laurel Road | Citizens Bank |

|---|---|---|---|---|

| Min. Credit Score | 650 | 680 | 660 | 650 |

| Terms Offered | 5–20 years (custom) | 5, 7, 10, 15, 20 yrs | 5, 7, 10, 15, 20 yrs | 5–20 years |

| Fees | None | None | None | None |

| Cosigner Option | No | Yes | Yes | Yes |

| Unique Feature | Precision pricing | Member benefits | Med/dental refi perks | Loyalty discount |

9. Federal vs. Private Refinancing

It’s important to understand the difference between federal student loan consolidation and private refinancing. Refinancing with Earnest converts your federal loans into private loans, meaning:

- Loss of federal protections like forbearance, deferment, and PSLF

- No access to income-driven repayment plans

- Potentially lower interest rates and better terms (for qualified borrowers)

10. Who Should Consider Refinancing with Earnest?

Refinancing with Earnest may be suitable for:

- Graduates with stable income and good credit

- Borrowers with high-interest private or PLUS loans

- Individuals not relying on federal protections

- Those wanting customized payment options

11. Strategic Tips Before Refinancing

- Improve your credit score beforehand

- Pay off high-interest debt

- Compare multiple offers

- Ensure job and income stability

- Understand trade-offs of losing federal benefits

12. Managing Your Refinance Loan Post-Approval

Earnest provides a sleek dashboard where you can:

- Track balances and due dates

- Make additional payments

- Adjust payment due dates

- Contact customer support

13. Frequently Asked Questions (FAQ)

Q1: Does refinancing hurt my credit score? A: Checking rates doesn’t affect your score, but final approval includes a hard inquiry, which may lower your score slightly.

Q2: Can I refinance more than once with Earnest? A: Yes, you can refinance again if your financial situation improves.

Q3: Is there a penalty for paying off early? A: No, Earnest doesn’t charge prepayment penalties.

Q4: Can I include parent PLUS loans? A: Yes, provided the borrower is eligible.

Q5: What if I move to a state Earnest doesn’t cover? A: Your loan remains active even if you relocate later.

14. Real-World Testimonials

Sarah W., San Diego, CA: “Earnest gave me a much lower interest rate than my original loan. I love that I could set my exact term and save thousands in interest.”

Brian K., Chicago, IL: “As a freelancer, traditional lenders wouldn’t approve me. Earnest took a broader look at my finances and approved my application. It’s been life-changing.”

15. The Future of Earnest and Loan Refinancing

With the ongoing evolution of fintech, companies like Earnest continue to innovate. Expect more automation, AI-driven loan customization, and mobile-first platforms. Borrowers will benefit from:

- Better financial insights

- Real-time notifications

- Dynamic interest rate updates

Conclusion

Refinancing your student loans with Earnest can be a smart financial move if you meet the eligibility criteria and fully understand the implications. With its borrower-first philosophy, custom repayment options, and competitive rates, Earnest is an excellent option for graduates seeking financial flexibility and long-term savings. However, it’s crucial to evaluate your personal financial goals, job stability, and reliance on federal benefits before committing. By taking a strategic, informed approach, you can turn your student loan burden into a manageable and even empowering part of your financial journey.