Home and auto insurance massachusetts – Home and auto insurance in Massachusetts are essential for protecting your assets. From legal requirements to coverage options, this guide dives deep into everything you need to know.

Overview of Home and Auto Insurance in Massachusetts

Home and auto insurance are essential protections for residents in Massachusetts. They provide financial security and peace of mind in the event of unexpected accidents or disasters.

Importance of Having Home and Auto Insurance

Having home insurance is crucial to protect your property and personal belongings from damages caused by fire, theft, or natural disasters. Auto insurance is required by law to cover medical expenses and property damage resulting from car accidents.

Legal Requirements for Home and Auto Insurance

In Massachusetts, it is mandatory to have auto insurance with minimum liability coverage limits to operate a vehicle legally on the road. Home insurance is not required by law, but mortgage lenders typically require homeowners to have a policy to protect their investment.

Common Coverage Options

Common coverage options for home insurance in Massachusetts include dwelling coverage, personal property coverage, liability protection, and additional living expenses coverage. Auto insurance typically includes liability coverage, collision coverage, comprehensive coverage, and personal injury protection.

Choosing the Right Insurance Coverage

Choosing the right insurance coverage is crucial to ensure adequate protection for your home and vehicle.

Types of Home Insurance Coverage

Homeowners in Massachusetts can choose from different types of home insurance policies such as HO-3, HO-5, and HO-6, each offering varying levels of coverage for your property and personal belongings.

Factors to Consider for Auto Insurance

When selecting auto insurance coverage in Massachusetts, consider factors such as your driving record, the value of your vehicle, and your budget. Comprehensive coverage and collision coverage are important options to consider.

Cost Savings through Bundling Policies

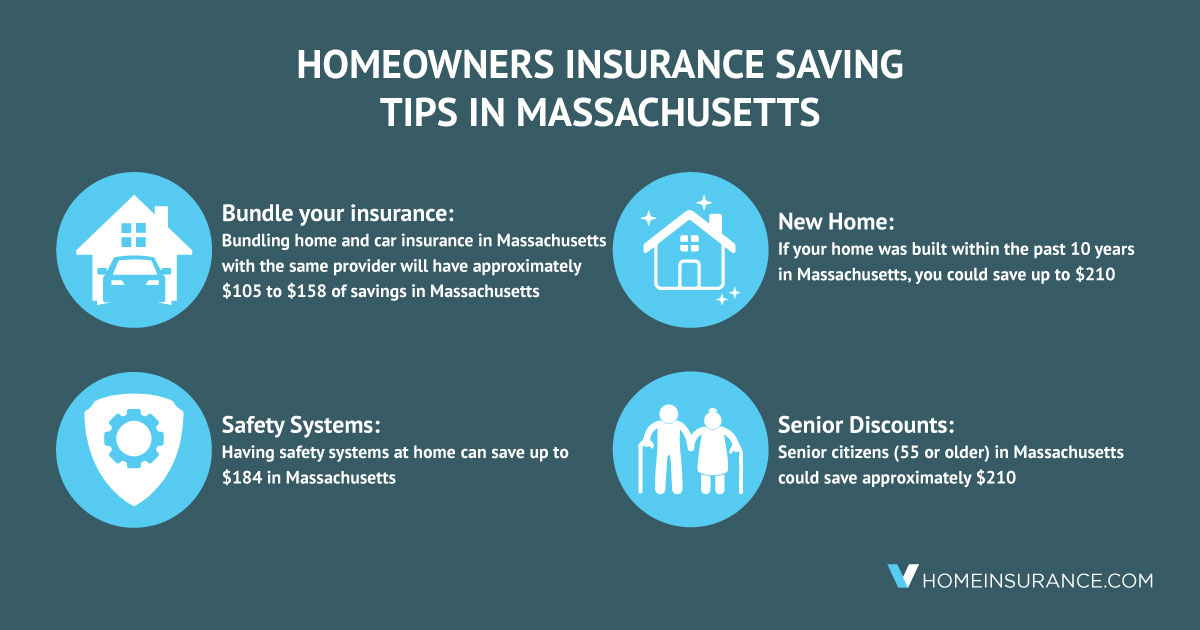

Bundling home and auto insurance policies with the same provider can lead to cost savings through multi-policy discounts. This can help reduce your overall insurance premiums while simplifying the management of your policies.

Finding Affordable Insurance Policies

Finding affordable insurance policies in Massachusetts requires careful consideration and comparison.

Strategies for Affordable Home Insurance

To find affordable home insurance, consider increasing your deductible, improving home security measures, and comparing quotes from multiple insurance providers to find the best rates.

Tips for Discounts on Auto Insurance, Home and auto insurance massachusetts

Auto insurance discounts in Massachusetts may be available for safe driving habits, bundling policies, completing driver safety courses, and insuring multiple vehicles. Take advantage of these discounts to reduce your premiums.

Role of Deductibles in Insurance Costs

The deductible amount you choose for your home and auto insurance policies can impact your insurance costs. A higher deductible typically results in lower premiums, but be prepared to pay more out of pocket in the event of a claim.

Filing Claims and Dealing with Insurance Companies

Knowing how to file claims and handle insurance companies is essential when dealing with home and auto insurance.

Process of Filing a Home Insurance Claim

When filing a home insurance claim in Massachusetts, document the damage, contact your insurance company promptly, and follow their instructions to ensure a smooth claims process.

Dealing with Auto Insurance Companies

After a car accident, contact your auto insurance company immediately to report the incident. Provide accurate information and cooperate with the claims adjuster to expedite the claims process.

Tips for Handling Disputes with Insurance Companies

If you encounter disputes with insurance companies regarding home or auto insurance claims, document all communication, seek clarification on policy details, and consider involving a mediator or legal counsel to resolve the issue effectively.

Ending Remarks: Home And Auto Insurance Massachusetts

In conclusion, understanding the nuances of home and auto insurance in Massachusetts is crucial for making informed decisions to safeguard your belongings and loved ones. Explore the intricacies discussed here to navigate the insurance landscape with confidence.

Essential Questionnaire

What are the legal requirements for home and auto insurance in Massachusetts?

In Massachusetts, drivers are required to have auto insurance to cover liabilities in case of accidents. For home insurance, there is no legal requirement, but it is highly recommended to protect your property.

How can I find affordable home insurance policies in Massachusetts?

To find affordable home insurance in Massachusetts, consider bundling your policies, increasing deductibles, and comparing quotes from different insurance providers.

What factors should I consider when selecting the right auto insurance coverage in Massachusetts?

When choosing auto insurance in Massachusetts, factors to consider include coverage limits, deductibles, types of coverage (liability, comprehensive, collision), and any additional riders you may need.