Does homeowners insurance cover tenants? This is a question that many homeowners and tenants alike may have. The answer is not always straightforward, as it depends on a number of factors, including the specific terms of the insurance policy and the nature of the damage or liability in question.

In this article, we will explore the coverage provided by homeowners insurance for tenants, including tenant liability coverage, property damage coverage, and personal property coverage. We will also discuss any exclusions or limitations that may apply and provide guidance on how tenants can obtain their own renters insurance for personal property protection.

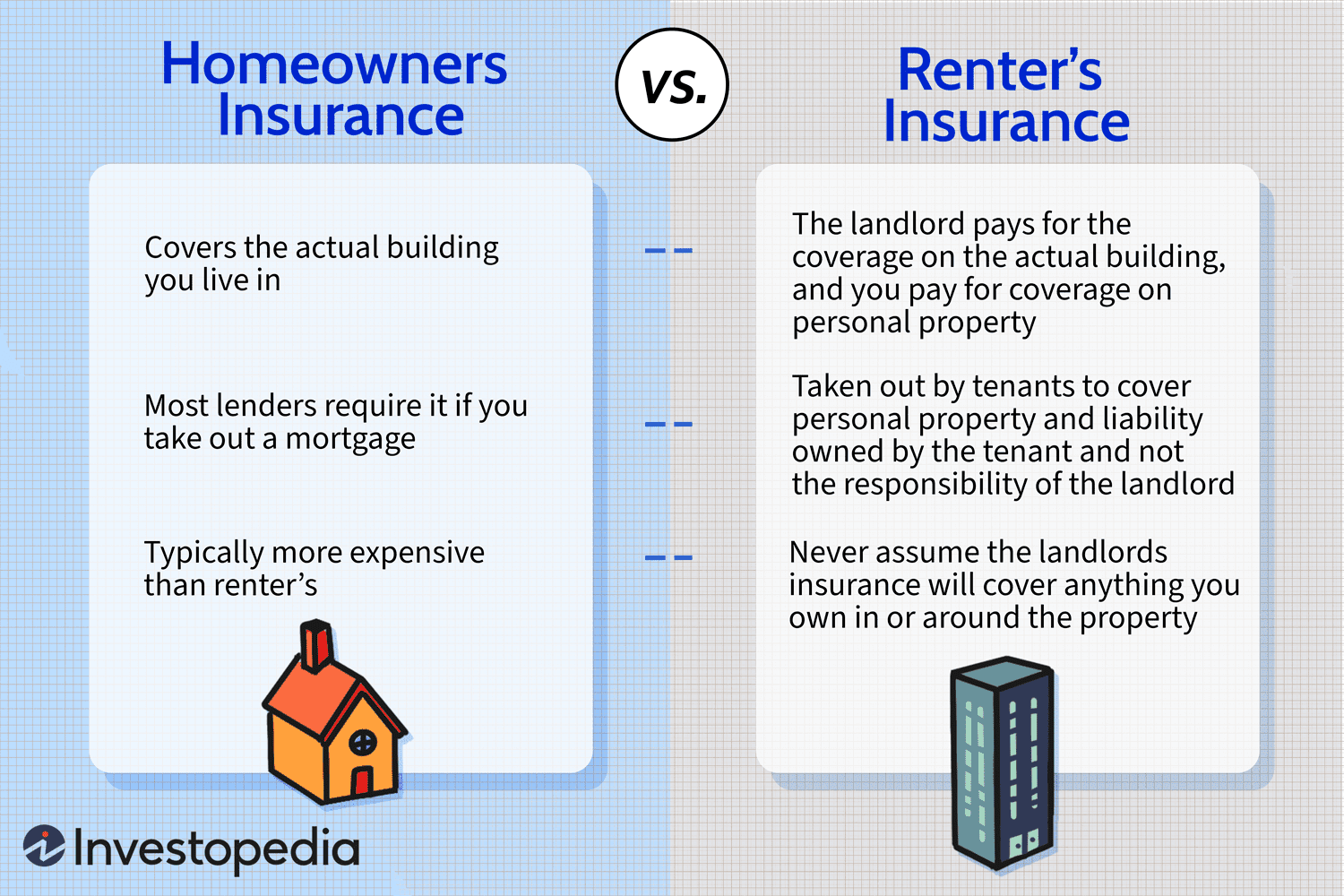

Homeowners insurance is designed to protect the homeowner from financial losses associated with damage to their property or injuries to others on their property. However, in some cases, homeowners insurance may also provide coverage for tenants who live in the property.

This coverage can be beneficial for both homeowners and tenants, as it can help to protect them from financial responsibility in the event of an accident or other covered event.

Coverage Overview

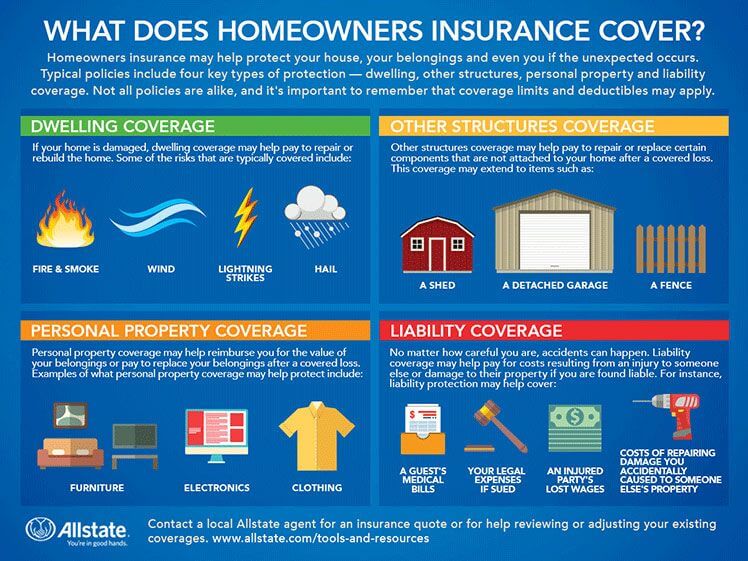

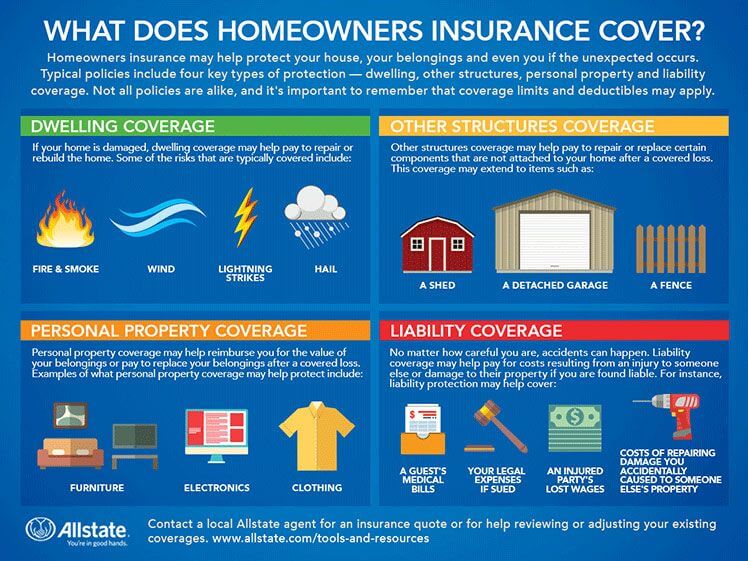

Homeowners insurance policies provide coverage for a variety of risks, including damage to the home, loss of personal belongings, and liability for injuries or damage caused to others.

There are different types of homeowners insurance policies, each with its own coverage limits and exclusions. The most common type of homeowners insurance policy is the HO-3 policy, which provides coverage for the following:

- Dwelling: The structure of the home, including attached structures such as garages and porches.

- Other structures: Detached structures on the property, such as sheds, fences, and pools.

- Personal belongings: The personal belongings of the homeowner and their family members, including clothing, furniture, and electronics.

- Loss of use: The cost of temporary housing and other expenses if the home is damaged and uninhabitable.

- Liability: The homeowner’s legal liability for injuries or damage caused to others.

There are a number of exclusions and limitations that may apply to tenant coverage under a homeowners insurance policy. For example, most homeowners insurance policies do not cover the personal belongings of tenants.

Tenant Liability Coverage

Tenant liability coverage is a crucial aspect of homeowners insurance that protects homeowners from legal liability arising from injuries or property damage caused by their tenants.

It provides financial protection in scenarios where the tenant is held responsible for accidents, negligence, or damages occurring within the rental property.

Coverage Scenarios

Tenant liability coverage can be applicable in various situations, including:

- Bodily injury to guests or visitors caused by the tenant’s actions or negligence.

- Property damage to the rental unit or personal belongings of others due to the tenant’s carelessness or misuse.

- Libel, slander, or defamation committed by the tenant, resulting in financial losses or harm to reputation.

Coverage Limits and Restrictions

Tenant liability coverage typically has limits and restrictions:

- Coverage limits:Homeowners insurance policies often have a maximum amount of coverage for tenant liability, ranging from $100,000 to $500,000 or more.

- Exclusions:Tenant liability coverage may not cover intentional acts, criminal activities, or damages caused by pets.

- Deductibles:In some cases, homeowners may have to pay a deductible before the insurance company covers the liability claim.

Property Damage Coverage

Homeowners insurance can provide coverage for damage to the property caused by tenants, offering peace of mind to landlords and ensuring the financial protection of their investment.

This coverage typically extends to various types of property damage, including:

Accidental Damage

- Tenant negligence or carelessness, such as spilling paint on the carpet or breaking a window.

- Acts of nature, such as a storm or earthquake, that cause damage to the property while the tenant is occupying it.

Malicious Acts, Does homeowners insurance cover tenants

- Intentional or willful damage caused by the tenant, such as vandalism or graffiti.

- Acts of third parties, such as a guest or intruder, that occur while the tenant is responsible for the property.

However, it’s important to note that homeowners insurance may have exclusions or limitations on property damage coverage. For example, damage caused by normal wear and tear, pest infestations, or acts of war may not be covered. Landlords should carefully review their policy to understand the specific terms and conditions of their coverage.

Personal Property Coverage

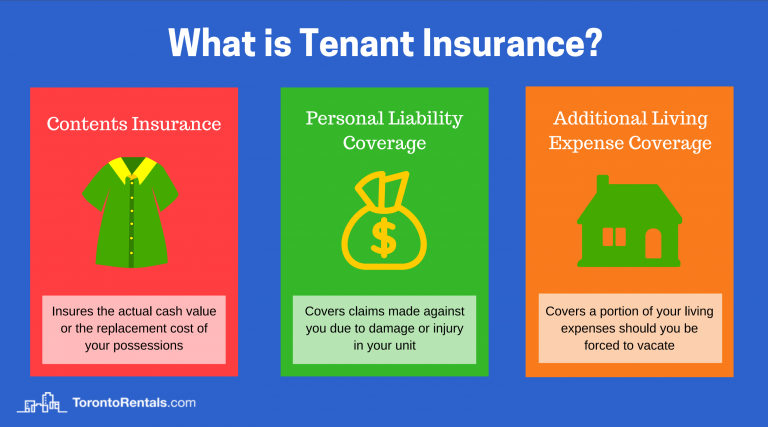

Homeowners insurance typically does not cover personal property belonging to tenants. Tenants are responsible for obtaining their own renters insurance to protect their belongings.

Limits or Restrictions on Personal Property Coverage for Tenants

If a tenant’s personal property is damaged or stolen while living in a rental unit, the landlord’s homeowners insurance may not cover the loss. Homeowners insurance typically only covers the structure of the home and the landlord’s personal belongings.

How Tenants Can Obtain Renters Insurance for Personal Property Protection

Tenants can obtain renters insurance from a variety of insurance companies. Renters insurance is relatively inexpensive and can provide peace of mind in the event of a loss.

Endorsements and Riders

Endorsements and riders are additional coverages that can be added to homeowners insurance policies to enhance tenant coverage. They can provide additional protection for tenants’ personal property, liability, and other expenses.

Some common endorsements and riders that can be added to homeowners insurance policies for tenants include:

Tenant Liability Coverage Endorsement

This endorsement provides additional liability coverage for tenants in case they are sued for damages or injuries caused to others while living in the rental property.

Benefits:

- Provides additional protection for tenants in case of lawsuits

- Can help cover legal fees, medical expenses, and other costs associated with a lawsuit

Limitations:

- May not cover all types of liability

- May have a limit on the amount of coverage

Example:A tenant accidentally starts a fire in their apartment that damages the building and injures a neighbor. The tenant liability coverage endorsement can help cover the costs of the damage and injuries.

Epilogue: Does Homeowners Insurance Cover Tenants

In conclusion, whether or not homeowners insurance covers tenants depends on a number of factors, including the specific terms of the insurance policy and the nature of the damage or liability in question. It is important for both homeowners and tenants to understand the coverage provided by their insurance policies so that they can make informed decisions about their insurance needs.

FAQ Section

What is tenant liability coverage?

Tenant liability coverage is a type of insurance that protects homeowners from financial liability if a tenant causes damage to the property or injuries to others while living in the property.

Does homeowners insurance cover personal property belonging to tenants?

In most cases, homeowners insurance does not cover personal property belonging to tenants. Tenants should obtain their own renters insurance to protect their personal belongings.

Can homeowners add endorsements or riders to their insurance policies to enhance tenant coverage?

Yes, homeowners can add endorsements or riders to their insurance policies to enhance tenant coverage. These endorsements or riders can provide additional coverage for things like tenant liability, property damage, and personal property.