In today’s competitive business environment, efficiency and integration are the keys to success. Managing customer relationships while keeping financial records in order can be overwhelming without the right tools. That’s where Customer Relationship Management (CRM) software comes in—especially CRMs that integrate seamlessly with accounting platforms like QuickBooks.

QuickBooks is one of the most widely used accounting solutions, particularly for small to medium-sized businesses. It allows users to manage expenses, track sales, and handle payroll with ease. When paired with a compatible CRM, the combination can significantly streamline operations, reduce manual entry, and increase productivity.

This comprehensive guide explores the best CRM systems that integrate with QuickBooks, the benefits of this integration, key features to consider, and top recommendations to help businesses choose the perfect CRM for their needs.

Why Integrating CRM with QuickBooks Matters

Before diving into specific CRM tools, it’s essential to understand why integrating your CRM with QuickBooks is a game-changer for business operations.

. Centralized Customer Data

By connecting your CRM with QuickBooks, all customer information—from contact details to transaction history—is centralized in one place. This leads to more informed sales decisions and better customer service.

. Improved Efficiency

Data synchronization between CRM and QuickBooks eliminates the need for duplicate data entry, reducing human error and saving valuable time for sales, finance, and customer support teams.

. Accurate Financial Reporting

CRMs integrated with QuickBooks offer real-time financial insights, enabling businesses to make data-driven decisions, forecast revenues, and track payments more efficiently.

. Enhanced Customer Experience

With detailed customer profiles and financial history, sales representatives can personalize their interactions, provide tailored offers, and resolve issues faster—leading to improved customer satisfaction.

. Streamlined Invoicing and Payments

Integrated systems allow you to create invoices, manage payments, and monitor billing statuses directly from your CRM. This seamless workflow ensures faster payment cycles and better cash flow management.

Key Features to Look for in a CRM Integrated with QuickBooks

Not all CRMs offer the same level of integration or functionality with QuickBooks. When evaluating your options, consider the following features:

. Bi-directional Sync

Ensure the CRM allows bi-directional data sync with QuickBooks so changes made in one platform are reflected in the other. This includes customer details, sales information, and invoice status.

. Invoicing Capabilities

The ability to generate and manage QuickBooks invoices directly from the CRM saves time and reduces errors.

. Real-time Financial Data

Access to live financial data—such as outstanding balances, paid invoices, and customer purchase history—is crucial for timely decision-making.

. Sales Pipeline Management

A robust CRM should offer tools to manage your sales pipeline, track leads, schedule follow-ups, and close deals efficiently—all while keeping financials aligned with QuickBooks.

. Automation Features

Automating tasks like sending payment reminders, generating invoices, or updating customer records can significantly improve workflow efficiency.

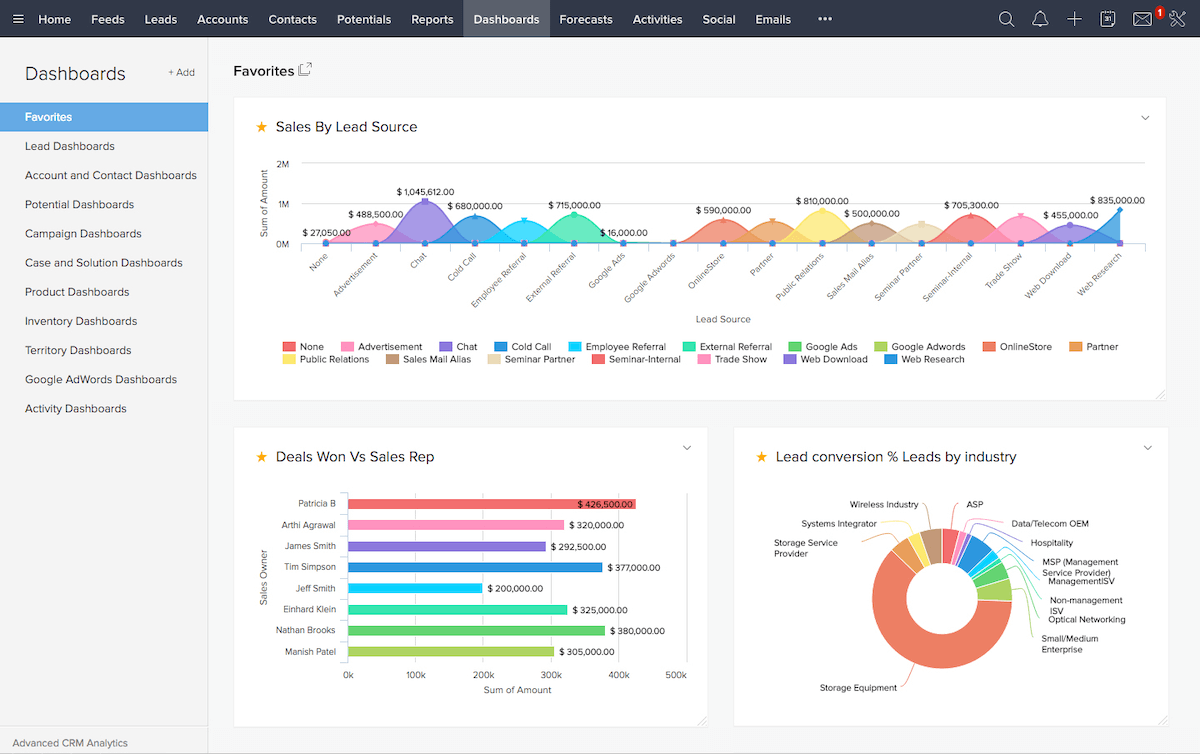

. Reporting and Analytics

Advanced reporting features provide valuable insights into sales performance, revenue trends, and customer behavior, helping businesses refine their strategies.

Benefits of a CRM and QuickBooks Integration in Practice

Here are real-world benefits businesses experience after integrating their CRM with QuickBooks:

. Enhanced Sales Performance

Sales teams have full visibility into customer purchasing behavior, enabling them to upsell, cross-sell, and tailor their approach for better conversion rates.

. Faster Payments and Cash Flow Management

With instant access to invoice and payment status, businesses can follow up with clients efficiently, speeding up collections and improving cash flow.

. Better Decision-Making

Integrated reports offer insights into sales performance, customer lifetime value, and profitability, helping managers make informed business decisions.

. Reduced Operational Costs

By eliminating manual data entry and reducing errors, businesses save time and money on administrative tasks.

. Improved Collaboration

Both sales and finance teams work with the same up-to-date customer information, improving communication and team collaboration.

Advanced Integration Strategies

Once the basic integration between a CRM and QuickBooks is implemented, businesses can go beyond standard synchronization and explore advanced strategies to unlock even greater value.

1. Custom Workflows and Automation

Automation is one of the most powerful features when integrating a CRM with QuickBooks. Businesses can automate a range of tasks to reduce manual effort and streamline operations.

Examples of advanced automation:

-

Automatically generate invoices when a deal is marked as “won” in the CRM.

-

Send reminders to customers when payment due dates approach.

-

Trigger personalized follow-up emails after a customer makes a payment.

-

Notify the finance team when high-value deals close to ensure invoicing occurs promptly.

These workflows can be created using native CRM tools or with platforms like Zapier, Make (Integromat), or even custom-coded solutions for businesses with specific needs.

2. Customer Portals

Some CRMs, like Method:CRM, allow businesses to offer customer portals. This lets clients view estimates, pay invoices, and check account balances online—all tied directly to QuickBooks.

Customer portals:

-

Improve customer experience and transparency.

-

Reduce support tickets and billing inquiries.

-

Accelerate payment cycles by allowing customers to self-service.

3. Sales and Revenue Forecasting

With CRM and QuickBooks data combined, businesses can build predictive models that forecast future sales and revenue. This insight helps with strategic planning, resource allocation, and setting realistic financial goals.

Forecasts may be based on:

-

Historical sales trends.

-

Customer buying patterns.

-

Current deal pipeline value.

-

Seasonal or industry-specific data.

4. Integration with Other Business Tools

CRMs and QuickBooks become even more powerful when integrated with other platforms such as:

-

Email marketing tools (e.g., Mailchimp, Constant Contact)

-

E-commerce platforms (e.g., Shopify, WooCommerce)

-

Project management tools (e.g., Trello, Asana)

-

Customer service systems (e.g., Zendesk, Freshdesk)

This creates a unified business ecosystem where all data flows smoothly, and teams can work collaboratively without silos.

Real-World Case Studies

Understanding how other businesses have successfully integrated CRM with QuickBooks can offer valuable insight. Below are several real-world case studies across different industries.

Case Study 1: A Marketing Agency Using HubSpot + QuickBooks

Business Type: Digital marketing firm with 12 employees

Challenge: Disconnected sales and accounting systems leading to missed invoices and poor follow-ups.

Solution: Integration of HubSpot CRM with QuickBooks via PieSync.

Results:

-

50% reduction in overdue invoices.

-

Improved sales and accounting team communication.

-

Monthly revenue tracking dashboards built using synced data.

Case Study 2: Construction Company Using Method:CRM + QuickBooks

Business Type: Residential construction firm

Challenge: Manual invoice creation and disconnected field-to-office communication.

Solution: Method:CRM implementation with deep QuickBooks Desktop integration.

Results:

-

30% reduction in administrative time.

-

Contractors in the field can create estimates and send them directly to QuickBooks.

-

Instant invoice tracking with payment reminders improved cash flow.

Case Study 3: E-commerce Store Using Zoho CRM + QuickBooks Online

Business Type: Niche e-commerce retailer

Challenge: Difficulty tracking customer buying behavior and reconciling orders with financial records.

Solution: Integration of Zoho CRM with QuickBooks Online and Shopify.

Results:

-

20% increase in customer retention due to personalized follow-ups.

-

Streamlined financial reconciliation.

-

Better stock and revenue forecasting using CRM analytics.

Checklist for a Successful CRM and QuickBooks Integration

Here’s a practical checklist to help businesses ensure a smooth and successful integration:

. Define your business goals (e.g., automate invoicing, improve sales tracking).

. Choose a CRM with proven QuickBooks compatibility.

.Clean and back up your data before migration.

. Identify fields that need to sync between both systems.

. Decide between native or third-party integration tools.

. Run a test integration and troubleshoot issues.

. Train staff on how to use the integrated system.

. Set up automation rules and reporting tools.

. Monitor data flow regularly.

. Adjust and optimize based on feedback and performance.

Implementation Best Practices

The road to a successful CRM-QuickBooks integration starts with proper implementation. Poor setup can lead to sync failures, data corruption, or loss of productivity. Here’s a proven approach to getting it right the first time.

1. Define Integration Objectives

Before integrating, you need to ask:

-

What are our main goals (e.g., reduce billing errors, improve customer insights)?

-

Which departments will use the system (Sales, Accounting, Support)?

-

What types of data should flow between CRM and QuickBooks?

Clear objectives help you tailor the integration to fit real-world business needs.

2. Choose the Right Integration Method

You typically have three options:

-

Native Integration: Offered directly by the CRM (e.g., Method:CRM, Zoho CRM).

-

Third-party Tools: Services like Zapier, Automate.io, and OneSaas.

-

Custom API Integration: For businesses with unique requirements or large-scale operations.

3. Clean and Organize Your Data

Before syncing, conduct a data audit to remove duplicates, standardize formats, and ensure consistency. A messy database can lead to errors in syncing or financial reports.

Tips:

-

Use data validation tools.

-

Segment contacts (clients, vendors, leads).

-

Standardize date formats, address fields, and item descriptions.

4. Run Pilot Testing

Implement the integration with a small dataset or test environment. Monitor for:

-

Duplicate entries.

-

Mismatched fields.

-

System lag or sync delays.

Fix issues before a full-scale launch.

5. Develop SOPs (Standard Operating Procedures)

Document procedures for how to:

-

Add new clients.

-

Issue invoices.

-

Log communication.

-

Resolve sync errors.

This improves consistency and team efficiency.

Staff Training and Onboarding

The most powerful CRM-QuickBooks system is useless if your team doesn’t know how to use it effectively. Invest in ongoing training to ensure adoption.

1. Training for Different Departments

-

Sales team: Learn how to convert leads, track pipelines, and send quotes.

-

Finance team: Focus on invoices, payment tracking, and financial reporting.

-

Customer service: Understand how to access customer history and open cases.

2. Offer Live and Asynchronous Options

Not everyone learns the same way. Combine:

-

Live virtual sessions or in-person workshops.

-

Pre-recorded video tutorials.

-

Written guides with screenshots.

3. Assign Internal Superusers

Appoint “power users” or CRM champions who are well-trained and available to help others on the team. This reduces dependence on external support and boosts internal confidence.

4. Monitor Usage

Use CRM analytics to track:

-

Login frequency.

-

Feature utilization.

-

Data entry accuracy.

Low usage may signal the need for retraining or process simplification.

Measuring ROI of CRM + QuickBooks Integration

Integration is an investment—time, money, and effort. Businesses must evaluate whether the return is worth it. Here’s how to quantify the benefits:

– Time Saved

Track how much time employees spent on:

-

Manually creating invoices.

-

Following up on payments.

-

Entering customer details in multiple systems.

Automated processes typically cut admin time by 20–40%.

– Faster Payments

Monitor accounts receivable turnover before and after implementation. Many businesses see payments arrive 10–20% faster due to automated reminders and more accurate billing.

– Increased Revenue

CRM features like follow-up tasks, customer segmentation, and personalized outreach lead to higher sales conversion rates. Sales reps can focus more on selling, not data entry.

– Improved Data Accuracy

Clean, consistent data helps improve reporting, forecasting, and compliance. Businesses with synced systems report 25% fewer data errors on average.

– Lower Operational Costs

Fewer errors and faster billing lead to reduced costs in customer support, billing disputes, and late-payment penalties.

CRM-QuickBooks Integration by Industry

Different industries benefit uniquely from the integration. Here’s how various sectors can leverage it:

– Professional Services

Law firms, consultants, and agencies often invoice by time. CRM + QuickBooks lets them:

-

Track hours within the CRM.

-

Auto-generate invoices.

-

Offer client portals for payment.

– E-Commerce

Online retailers benefit from syncing customer data, order history, and inventory between platforms.

-

Real-time sales updates.

-

Automatic tax and shipping calculations.

-

Cross-channel sales reporting.

– Construction and Home Services

Field-based businesses use CRM mobile apps to:

-

Quote jobs on-site.

-

Send invoices upon completion.

-

Track payment status in the field.

– Nonprofits

For donor management and grant tracking:

-

CRMs like Zoho or Salesforce NPSP manage donors.

-

QuickBooks tracks fund allocations and reports.

Integration supports transparent reporting and donor communication.

Common Pitfalls to Avoid

Even great integrations can fail due to simple mistakes. Be aware of these red flags:

. Overcomplicating the Setup

Don’t try to sync every data point. Start with core elements (e.g., contacts, invoices) and expand later.

. Ignoring Data Governance

Make sure your team knows who is responsible for data entry, edits, and deletions. Without clear rules, data can quickly become disorganized.

. Neglecting Post-Implementation Reviews

Set a reminder 30, 60, and 90 days post-launch to evaluate system performance, gather feedback, and optimize.

. Failing to Train New Staff

Include CRM-QuickBooks training in onboarding programs. Institutional knowledge must be preserved as staff changes.

Summary Table: CRM vs QuickBooks Features

| Feature Category | CRM | QuickBooks |

|---|---|---|

| Customer Data | Tracks communication, preferences | Tracks billing and payments |

| Sales Pipeline | Yes | No |

| Marketing Automation | Yes | No |

| Invoicing | Limited (some CRMs offer this) | Full-featured |

| Payment Tracking | No | Yes |

| Reporting | Sales and customer insights | Financial and accounting reports |

| Integration Purpose | Manage relationships | Manage finances |

Together, they form a powerful ecosystem for end-to-end business management.

Final Thoughts

Integrating your CRM with QuickBooks is a game-changing move that combines financial accuracy with customer intelligence. This powerful synergy helps businesses:

-

Automate repetitive tasks.

-

Improve customer service.

-

Enhance cash flow visibility.

-

Enable smarter decisions based on real-time data.

But like any business tool, success comes down to how well it is implemented, adopted, and scaled.

By choosing the right CRM, aligning your teams, and focusing on measurable results, you can transform your business into a streamlined, customer-centric, and financially healthy organization.

Call to Action

If you’re just starting out, begin by listing the top 3 pain points in your current process—whether it’s missed invoices, delayed follow-ups, or lack of reporting clarity. Then evaluate CRMs that integrate with QuickBooks based on those needs.

Need help choosing or implementing the right solution? Consider reaching out to a certified CRM-QuickBooks consultant or exploring free trials from platforms like:

Conclusion

Integrating a CRM with QuickBooks offers a powerful advantage for businesses looking to streamline operations, boost productivity, and deliver outstanding customer experiences. The right CRM not only centralizes your sales and customer data but also provides financial transparency and automation that can save time and reduce errors.

From cost-effective solutions like Zoho and HubSpot to deeply integrated platforms like Method:CRM, there’s a CRM for every business type and budget. By understanding your needs, evaluating the available options, and following best practices for implementation, you can unlock the full potential of CRM and QuickBooks integration.

Whether you’re a startup or a growing enterprise, investing in a CRM that works with QuickBooks is a strategic move toward smarter, more efficient business management.