AARP secondary insurance to Medicare provides essential coverage to supplement the benefits offered by Medicare, ensuring seniors have access to comprehensive healthcare. This insurance bridges gaps in coverage, offering peace of mind and financial protection.

Understanding the types of plans, eligibility criteria, and benefits of AARP secondary insurance to Medicare empowers seniors to make informed decisions about their healthcare coverage.

Introduction

AARP secondary insurance, also known as Medigap, is designed to supplement Medicare coverage and provide additional protection against out-of-pocket healthcare expenses. Medicare, the federal health insurance program for people aged 65 and older, covers a wide range of healthcare services, but it may not cover all costs, leaving beneficiaries responsible for deductibles, copayments, and other expenses.

AARP secondary insurance helps to fill these gaps in coverage, providing peace of mind and financial protection. By enrolling in an AARP Medigap policy, beneficiaries can reduce their out-of-pocket expenses and ensure they have access to the healthcare services they need.

Medicare Coverage

Medicare is divided into four parts, each covering different aspects of healthcare:

- Part A:Hospital insurance, covering inpatient hospital stays, skilled nursing facility care, and hospice care.

- Part B:Medical insurance, covering doctor visits, outpatient services, durable medical equipment, and preventive care.

- Part C:Medicare Advantage, a private health insurance plan that combines Part A and Part B benefits into a single plan.

- Part D:Prescription drug coverage, covering the cost of prescription medications.

Types of AARP Secondary Insurance Plans

AARP offers a range of secondary insurance plans to supplement Medicare coverage, each with its own unique benefits and coverage. Understanding the different types of plans available can help you make an informed decision about which option is right for your needs.

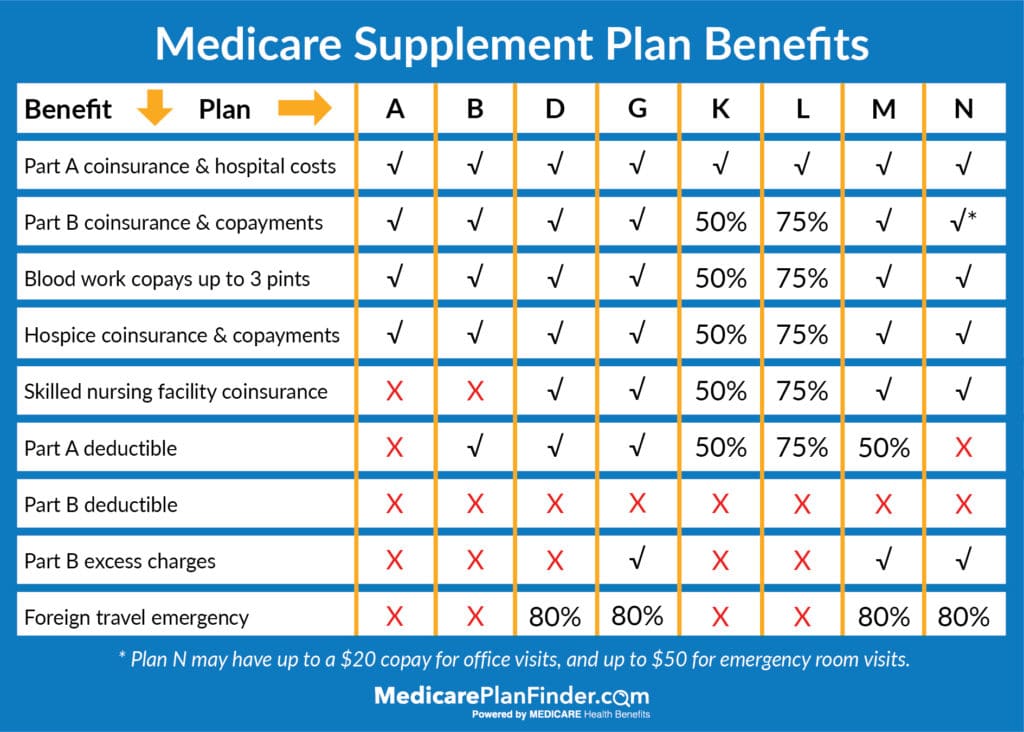

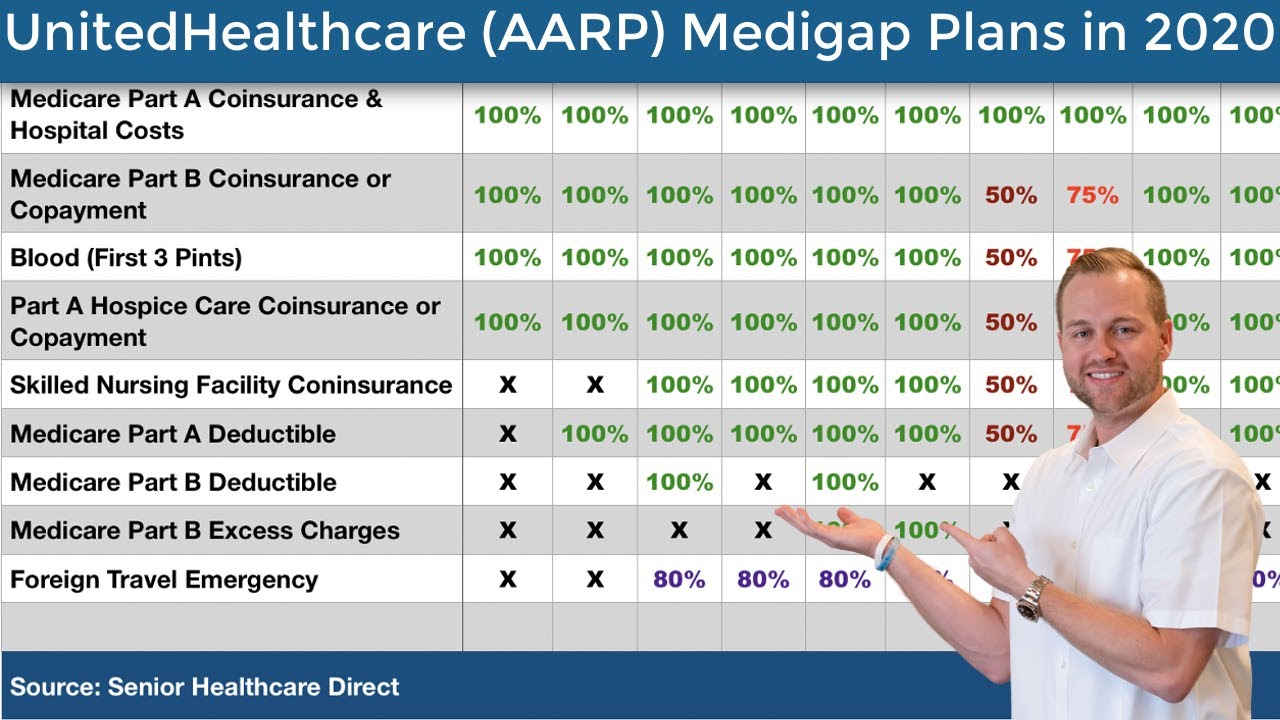

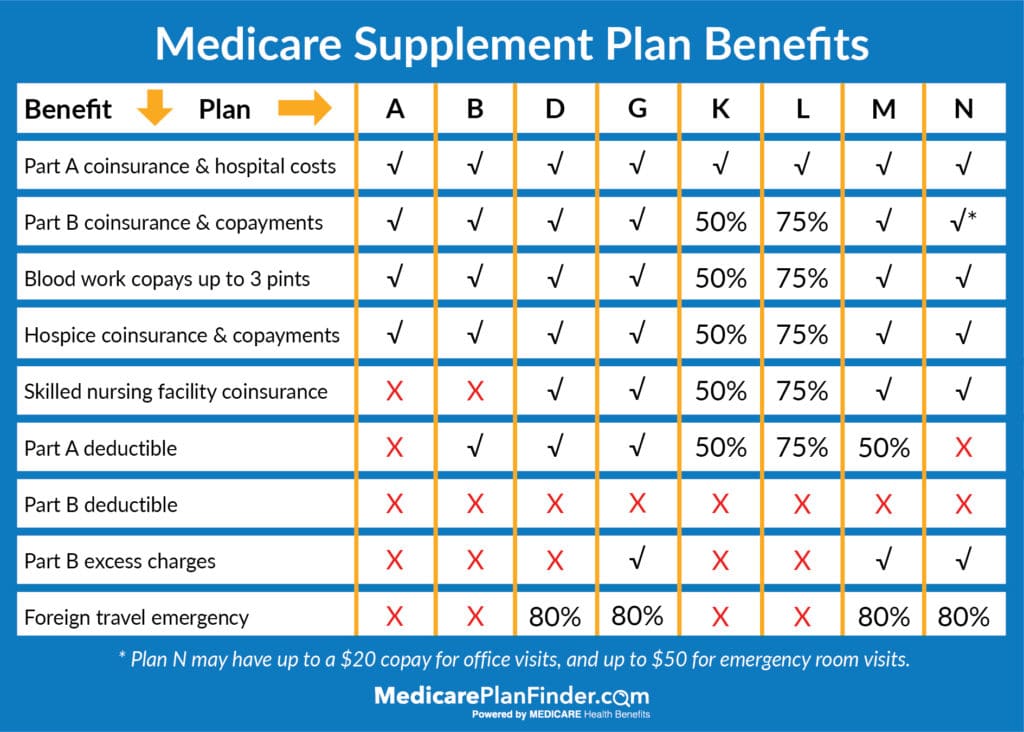

Medigap Plans

Medigap plans are designed to fill in the gaps in Original Medicare coverage. They cover expenses such as deductibles, copayments, and coinsurance. There are 10 standardized Medigap plans, each offering a different level of coverage. Plans A, B, and C provide basic coverage, while plans D, F, and G offer more comprehensive protection.

Medicare Advantage Plans

Medicare Advantage plans are an alternative to Original Medicare. They are offered by private insurance companies and provide a comprehensive package of benefits that includes all the benefits of Original Medicare, plus additional coverage such as prescription drug coverage, dental, vision, and hearing benefits.

Medicare Advantage plans typically have lower out-of-pocket costs than Medigap plans, but they also have more restrictions on where you can receive care.

Eligibility and Enrollment

AARP secondary insurance plans are available to individuals who are enrolled in Medicare Part A and Part B and meet certain eligibility criteria. To be eligible, you must:

- Be 50 years of age or older.

- Be a U.S. citizen or legal resident.

- Have Medicare Part A and Part B coverage.

To enroll in an AARP secondary insurance plan, you can contact AARP directly or through an insurance agent. You will need to provide your Medicare information, as well as information about your health and prescription drug coverage.

Costs and Premiums

AARP secondary insurance premiums vary depending on factors such as the type of plan, coverage level, and age of the policyholder. Generally, premiums for AARP secondary insurance plans are lower than those for primary insurance plans.

Premium Costs

Here are some examples of premium costs for different types of AARP secondary insurance plans:

- AARP Medicare Supplement Plan F: This plan offers comprehensive coverage and typically has higher premiums. For a 65-year-old male, the average monthly premium is around $250.

- AARP Medicare Supplement Plan G: This plan offers similar coverage to Plan F but with a higher deductible. The average monthly premium for a 65-year-old male is around $200.

- AARP Medicare Part D Prescription Drug Plan: This plan covers prescription drug costs. Premiums vary depending on the plan and the coverage level. The average monthly premium is around $40.

Benefits and Coverage

AARP secondary insurance plans offer a range of benefits and coverage options to supplement Medicare and provide additional protection against healthcare costs.

The specific benefits and coverage vary depending on the plan you choose. Some common benefits include:

- Coverage for deductibles, copayments, and coinsurance

- Out-of-pocket maximum protection

- Prescription drug coverage

- Dental and vision coverage

- Supplemental benefits, such as fitness programs and discounts on healthcare services

To help you compare the coverage of different plans, we have created the following table:

| Plan | Deductible | Copayment | Coinsurance | Out-of-Pocket Maximum | Prescription Drug Coverage | Dental and Vision Coverage | Supplemental Benefits |

|---|---|---|---|---|---|---|---|

| Plan A | $0 | $0 | 20% | $5,000 | Yes | No | No |

| Plan B | $2,000 | $0 | 0% | $6,000 | Yes | Yes | No |

| Plan C | $5,000 | $0 | 0% | $7,000 | No | No | Yes |

Limitations and Exclusions

AARP secondary insurance plans, like all insurance policies, have certain limitations and exclusions that determine what is covered and what is not. Understanding these limitations can help you avoid potential coverage gaps and ensure you have the right coverage for your needs.

One important limitation to be aware of is that AARP secondary insurance plans do not cover all medical expenses. They are designed to supplement Medicare, so they only cover expenses that are not covered by Medicare Part A or Part B.

This includes things like deductibles, coinsurance, and copayments.

Avoiding Coverage Gaps

To avoid coverage gaps, it is important to carefully review your AARP secondary insurance plan and make sure that it covers the expenses that you are most likely to incur. You should also consider purchasing additional coverage, such as a Medigap policy, to fill in any gaps in your coverage.

Choosing the Right Plan

Selecting the optimal AARP secondary insurance plan requires careful consideration of your specific needs and circumstances. Factors to ponder include your coverage requirements, financial constraints, and health status.

Coverage Needs

- Assess your current Medicare coverage and identify any gaps or limitations.

- Determine which additional benefits or services you seek, such as prescription drug coverage, dental or vision care.

- Consider your future healthcare needs and potential expenses.

Budget

- Determine the amount you can afford to pay for premiums and deductibles.

- Compare the costs of different plans to find the most cost-effective option.

- Explore any available discounts or subsidies that may reduce your financial burden.

Health Status, Aarp secondary insurance to medicare

- Consider your current and anticipated health conditions.

- Choose a plan that provides adequate coverage for your specific needs.

- Review the plan’s limitations and exclusions to ensure it meets your expectations.

Customer Service and Support: Aarp Secondary Insurance To Medicare

AARP provides comprehensive customer service and support to members of its secondary insurance plans. Members can access assistance through various channels, ensuring they receive the support they need.

One of the primary ways to access support is through the dedicated customer service hotline. Members can call the toll-free number to speak with a knowledgeable representative who can assist with questions, provide information, or resolve issues.

Online Support

AARP also offers online support options for its members. The AARP website features a comprehensive FAQ section that addresses common questions and provides answers. Additionally, members can access online chat support, where they can connect with a customer service representative in real-time.

Email Support

Members can also submit their queries or concerns via email. AARP has a dedicated email address where members can send their inquiries. The customer service team will respond to emails within a specified timeframe, providing assistance and resolving issues.

Additional Support Resources

In addition to these primary support channels, AARP offers various other resources to assist members. These resources include:

- Online forums:AARP maintains online forums where members can connect with each other, share experiences, and seek support from fellow members.

- Local chapters:AARP has local chapters across the country where members can attend meetings, participate in activities, and connect with other members in their area.

- Educational materials:AARP provides a range of educational materials, including articles, webinars, and videos, to help members understand their insurance plans and make informed decisions.

End of Discussion

Choosing the right AARP secondary insurance plan can significantly enhance Medicare coverage, providing seniors with the peace of mind that comes with knowing they have access to quality healthcare. By carefully considering coverage needs, budget, and health status, seniors can select a plan that meets their specific requirements and ensures they receive the care they deserve.

Essential FAQs

What are the eligibility requirements for AARP secondary insurance to Medicare?

Individuals who are enrolled in Medicare Part A and Part B are eligible for AARP secondary insurance to Medicare.

How do I enroll in an AARP secondary insurance plan?

You can enroll in an AARP secondary insurance plan through AARP’s website, by calling their customer service line, or by contacting a licensed insurance agent.

What are the benefits of AARP secondary insurance to Medicare?

AARP secondary insurance to Medicare offers a range of benefits, including coverage for deductibles, coinsurance, and copayments, as well as additional benefits such as dental and vision coverage.