Ohio insurance rates sets the stage for this enthralling narrative, offering readers a glimpse into a story that is rich in detail with formal and friendly language style and brimming with originality from the outset.

Exploring how various factors impact insurance rates, comparing providers, legal requirements, and trends in Ohio insurance rates will be highlighted in this comprehensive discussion.

Factors Affecting Ohio Insurance Rates

Age, gender, location, driving record, credit history, and the type of coverage all play a significant role in determining insurance rates in Ohio. Demographics such as age and gender can impact rates due to statistical risk factors associated with different age groups and genders. Location also plays a role, as urban areas may have higher rates of accidents or theft, leading to higher premiums.

The driver’s record and credit history are crucial factors in determining insurance premiums. A clean driving record typically results in lower rates, as it demonstrates responsible behavior on the road. On the other hand, a history of accidents or traffic violations may lead to higher premiums. Similarly, a good credit history can indicate financial responsibility, leading to lower insurance rates.

The type of coverage chosen also influences insurance rates. Liability coverage is typically less expensive than comprehensive or collision coverage, as it offers less protection. The make and model of the vehicle can also impact insurance costs, with more expensive or high-performance vehicles usually requiring higher premiums.

Comparison of Insurance Providers in Ohio

When comparing insurance providers in Ohio, it’s essential to consider the rates offered for various types of coverage. Different insurance companies may have different pricing strategies based on their target market and risk assessment. Additionally, the reputation and customer service of major insurance providers can influence the overall customer experience.

Analyzing the discounts and special offers provided by insurance companies can help Ohio residents save money on their premiums. Some insurers offer discounts for safe driving, bundling policies, or maintaining a good credit score. Bundling different insurance policies, such as auto and home insurance, can also lead to cost savings through multi-policy discounts.

Legal Requirements and Minimum Coverage in Ohio, Ohio insurance rates

In Ohio, drivers are required by law to carry a minimum amount of auto insurance coverage. This typically includes liability insurance to cover bodily injury and property damage in the event of an accident. Meeting these legal requirements is essential, as driving without insurance can result in fines, license suspension, or other penalties.

Beyond the state’s minimum requirements, drivers can choose additional coverage options to enhance their protection. These options may include comprehensive coverage for non-collision-related damages, uninsured motorist coverage, or medical payments coverage.

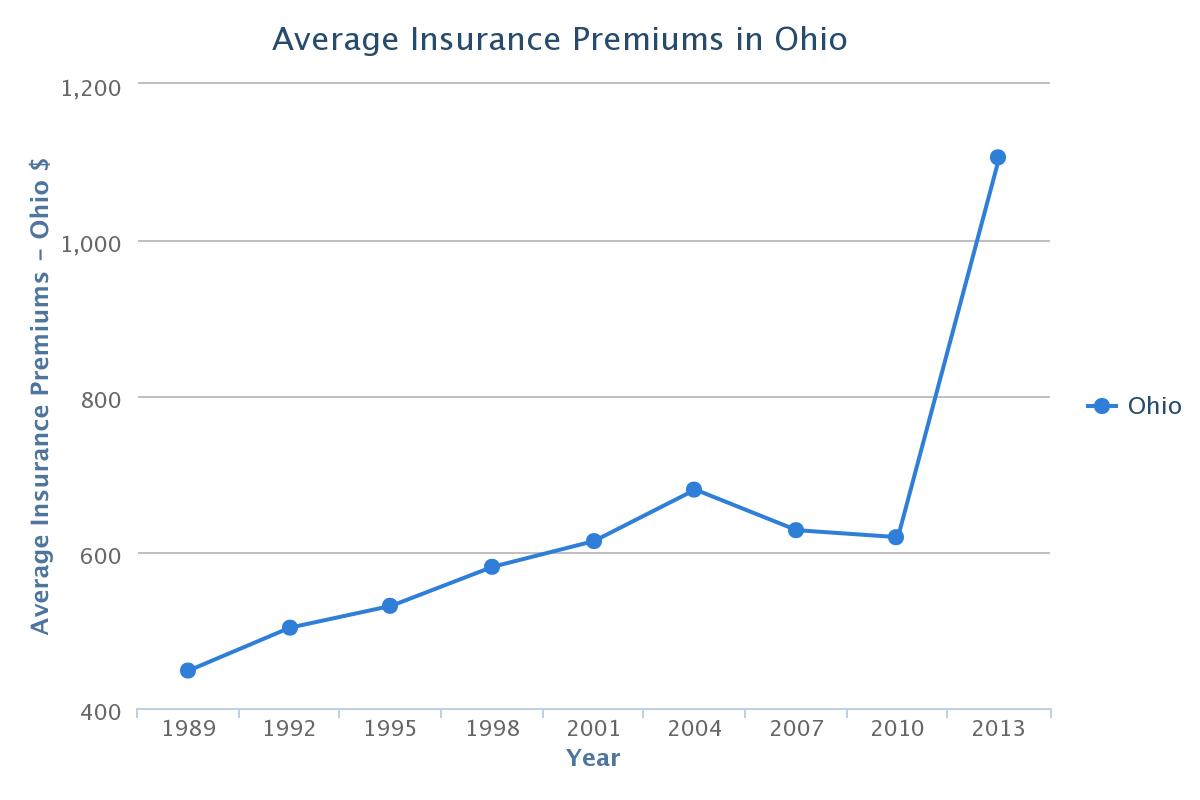

Trends and Changes in Ohio Insurance Rates

Recent trends in insurance rates in Ohio may be influenced by external factors such as economic conditions, regulatory changes, or advancements in technology. For example, an increase in the number of accidents or severe weather events could lead to higher insurance rates to cover potential claims.

Advancements in technology and data analytics are also impacting insurance rates in Ohio. Insurers may use telematics devices or algorithms to track driver behavior and adjust premiums accordingly. These technological innovations can lead to more personalized pricing based on individual risk factors.

Projected future changes in insurance rates in Ohio may be based on current trends and developments in the insurance industry. By staying informed about these changes, drivers can make informed decisions when purchasing or renewing their insurance policies.

Ending Remarks

In conclusion, Ohio insurance rates are influenced by a myriad of factors, and understanding these can help individuals navigate the complex world of insurance more effectively. Stay informed, compare providers, and stay abreast of trends to make informed decisions in managing your insurance needs.

Clarifying Questions: Ohio Insurance Rates

What factors can impact Ohio insurance rates?

Demographics like age, gender, location, driving record, credit history, type of coverage, and vehicle make and model can all influence insurance rates in Ohio.

How can bundling insurance policies affect costs in Ohio?

Bundling different insurance policies with the same provider can often lead to cost savings due to multi-policy discounts.

What are the legal requirements for insurance coverage in Ohio?

Ohio requires a minimum auto insurance coverage by law, and failing to meet these requirements can result in penalties.